We are 3 months into MiCA and things have been interesting. The guidance from ESMA (European Securities and Markets Authority) has been coming in, covering reverse-solicitation, non-compliant crypto-assets, DeFi and many other areas. Tether (USDT), the world’s largest stablecoin issuer has been impacted on the back of the Public Statement related to non-complaint crypto assets by being delisted on multiple EU crypto exchanges.

With that all happening, I still receive so many questions about the basics:

And so on…

So in this article, we will be going Back to Basics, but with the added benefit of what we now know from Q1 2025.

What is MiCA?

To recap, MiCA is the European Union’s Markets in Crypto-Assets Regulation, establishing a unified framework for crypto-assets across all EU member states. It aims to protect investors and consumers, preserve financial stability, ensure market integrity, and foster innovation in the crypto-asset sector.

Is MiCA already applicable?

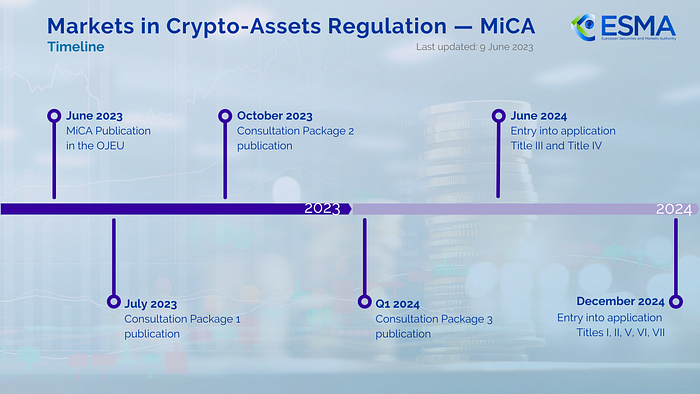

MiCA was approved by the EU parliament in 2023, with the majority of its rules coming into force on 30 December 2024.

A transition period of 18 months was provided for existing crypto service providers already operating under national law before December 2024. Some EU states can choose to shorten this transition internally. ESMA has provided a list of grandfathering periods provided by the EU states. After the grandfathering period ends (by July 2026 at latest), any firm not licensed under MiCA must cease services in the EU.

There has been a common misconception that Crypto-Asset Service Providers (CASPs) registered under national law can operate as if they had a MiCA license until the end of the grandfathering period in that jurisdiction, however, this is not the case. For instance, contrary to popular belief, passporting is not permitted without a MiCA license. ESMA, the European Securities and Markets Authority will maintain various public registers, including a CASP register, and also publish a list of non-complaint entities. They currently publish interim registers.

What does MiCA apply to?

Crypto-assets…Obviously

The scope is purposefully broad and applies to crypto-assets that are not already covered by existing EU financial regulations. So a CFD (Contract for Difference) on a crypto-asset (being a derivative), for example, would fall within the scope of MiFID II and not MiCA.

MiCA classifies crypto-assets into 3 groups:

- Electronic Money Tokens (EMTs): Crypto-assets whose stable value references only one official currency. Circle’s EURC is a good example here.

- Asset-Referenced Tokens (ARTs): Crypto-assets (which are not EMTs) whose value references an asset or a combination of multiple assets. While no entities have been entered into the ART issuers register by ESMA by April 2025, an example here can be Tether’s XAUt.

- Other crypto-assets: The catch-all for crypto-assets that do fall within the above 2 categories. E.g. ETH

MiCA doesn’t automatically apply to NFTs (non-funglible tokens). If NFTs are issued in a large series or fractionalised such that they are effectively fungible or traded as an investment, they may be deemed in scope. The same applies to DeFi. If a service is provided “in a fully decentralised manner without any intermediary”, it falls outside scope, however, this is intended to be a narrow carve-out. ESMA and the European Banking Authority (EBA) issued a joint report on DeFi which dives further into this topic and attempts to add clarity, however, there is still no clear definition as to what will be deemed sufficiently decentralised in this respect. MiCA also does not apply to central bank digital currencies (CBDCs) issued by the European Central Bank (ECB) and digital assets which may be issued by national central banks within the EU.

Who does MiCA apply to?

MiCA applies to issuers of crypto-assets and those whose business it is to provide services related to the crypto-assets in the EU or targeting EU investors.

Such services are rendered by Crypto Asset Service Providers (CASPs), and include: custody and administration of crypto-assets, operation of a crypto trading platform, exchange of crypto for fiat or crypto, execution of client orders, placement of crypto-assets, reception/transmission of orders, advice on crypto, portfolio management on crypto, and transfer services for crypto-assets. This covers, for eg, crypto exchanges, custodial wallet providers, brokers, advisers and portfolio managers.

An issuer offering crypto-assets to the public in the EU or seeking to list them on an EU trading platform must comply with MiCA (including non-EU projects marketing to Europe). There has been much debate about the difference (if any) between offering and seeking to list. Like all new regulations, time will tell how this will play out.

A CASP from outside the EU cannot serve EU clients without MiCA authorisation. There is one exception, reverse solicitation, where an EU customer at their own exclusive initiative seeks services from a third-country firm. This is narrowly interpreted to prevent abuse and ESMA has provided additional guidance.

What are the Key Points?

* Crypto-Asset Service Providers

CASPs form a major part of MiCA, bringing crypto exchanges, custodial wallet providers, brokers, and other intermediaries under a unified EU licensing regime.

In order to provide their services, they must obtain a license and fulfill the relevant requirements. If the firm is an existing financial institution (e.g. a MiFID II investment firm), it can formally notify the regulator and is exempt from separate CASP licensing for equivalent services. For example, Etoro is licensed by CySec under MiFID and provided such MiCA notification in January 2025.

In order to obtain and maintain a license, CASPs will need to meet various requirements:

- EU Presence; incorporated in a EU member state, have a local director and the effective management of the firm must take place there.

- Capital Requirements; based on services offered, a firm will be required to hold up to EUR150,000 of initial capital.

- Organisational and Governance Requirements; covering structure, risk, complaints, AML, and operational resilience (required under DORA) etc.

- Conduct of Business Requirements; transparency of fees, risks and the offering.

MiCA also details additional rules tailored to each type of crypto service.

* Issuers of Crypto-Assets, including ARTs and EMTs

The rules related to issuance of crypto-assets depends on the asset group referred to above. That will determine what is required and who may issue the crypto-asset. For example, only an EMI (E-money Institution) can issue an EMT. EMT and ART issuers are further required to hold reserves equal to 100% of the issued tokens. They are also not allowed to pay interest on ARTs or EMTs.

Market Abuse and Anti-Money Laundering Provisions

MiCA relies on other EU legislation to support its market abuse and AML efforts.

MiCA mirrors the EU Market Abuse Regulation (MAR), extending similar rules to crypto trading. This covers the prohibition of insider trading and market manipulation. These measures are welcomed with crypto markets rife with pump-and-dump schemes and manipulative practices. CASPs are required to monitor and report such activity and regulators are required to enforce these provisions.

Another misconception — Market Abuse doesn’t apply to ‘decentralised’ contexts. The market abuse provisions apply to any transaction, order or behaviour concerning crypto-assets irrespective of whether it takes place on a trading platform or not. This won’t be easy to monitor but… Hello X!

MiCA refers to the EU Anti-Money Laundering Directive (AMLD) regime to cover AML obligations. CASPs are required to monitor and report suspicious activity. The “travel rule” (Transfer of Funds Regulation) further requires CASPs to include originator and beneficiary information with crypto transfers.

Final thoughts

The first 3 months has seen mostly large institutions getting their MiCA licenses, some non-complaint entities entering the register (thanks Italy) and a few EMT issuers, with currently no ART issuers on the register.

While we try to navigate through MiCA together, we can expect a lot more input from ESMA and the industry itself.

Stay tuned.